Follow

the podcast on

Good morning and guess what? Things are looking up. The future's looking pretty good.

Not from budget announcements themselves, necessarily, but the Treasury forecasts.

We'll hit just shy of 3% growth next year. It'll average 2.9% across the next four years. Unemployment gets back below 5%. Inflation is beaten at 2%. Wages grow faster than costs at 2.7%.

These are the best forecasts we have, and they show that even if the global outlook gets worse, we'll still grow by a whisker shy of 3% next year.

We've been talking about them all year but thank the Lord for our primary sector exports. They're in high demand. Prices are up. Payouts are up. Tourism is coming back back on, albeit slowly.

Finally, after effectively two years of going backwards, and four years of feeling very poor, things look like they're finally turning a corner. The good old days are coming back.

But the pain isn't over yet. The forecasts have us actually going backwards 0.8% this year. And you can feel that and see it some of the confidence, employment, card spending and PSI data we spoke about the other day.

The services sector is still in contraction, unlike most of our trading partners.

The government surplus is also a fly in the ointment.

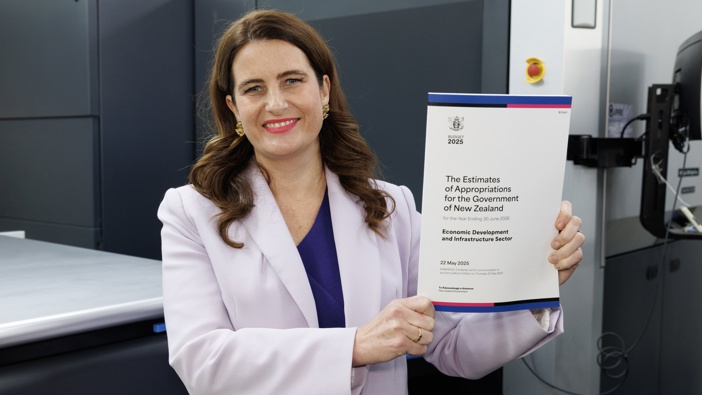

Despite average growth of almost 3% a year for the next four years, Nicola Willis won't, in any of them, return to books surplus and actually start paying down the debt.

Debt's costing us more than Defence, Police, Corrections, Justice, and Customs combined. It peaks at 46% in 2028 and won't come down below 40% target in this forecast period.

Why not? Net debt doubled under the last lot and your net borrowing is still increasing as a proportion of the economy, and the economy's going to grow.

Nicola Willis says this would have required harsher cuts to health and education. If you were running a business, you'd gut the costs out because there's more fat to trim.

But she's not running a business, she's running a country. Cut too deep and your risk being turfed out in 2026 and the next lot reversing all the cuts anyway. In a way, deep cuts are less sustainable, politically, than smaller, incremental ones.

That's not to take away from the growth track.

The question of reliability is a reasonable one to ask. Treasury's been wrong before. The elephant in the White House is, of course, Donald Trump. He's to economists what cyclones are to meteorologists, quite hard to predict with accuracy.

Trying to nail down an accurate forecast is like trying to whack a pinata, blindfolded, and drunk.

So all of this is to say that finally, on the whole, you'd have to feel a bit more hopeful about the future of this country today than you did yesterday.

Take your Radio, Podcasts and Music with you