In a new seven-day series, we investigate the rising cases of scammers, their ever-elaborate methods of targeting your money and what’s being done to combat them. What can you do to keep safe?

They might come in the form of a charming foreign woman or man.

It could be what appears to be a genuine text message from a public agency.

It might be someone who’s hacked into a Facebook or Trade Me account and is wreaking havoc by selling non-existent items.

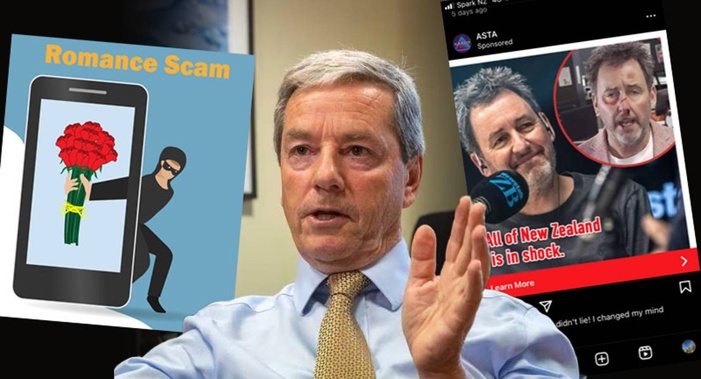

It could be an image of an “injured” Mike Hosking on Facebook. While an appearance of that nature might seem obviously fake to a good many of us, other people are sadly taken in.

There might even be a knock at the door. A real-life person offering an incredible investment scheme.

You have money and the scammers want it.

And they’re going to extensive, elaborate and ever-expanding attempts to access and prise open your bank account.

“Scams are like digital ram raids - thieves are stealing money from customers’ accounts. It’s as simple as that,” says Banking Association chief executive Roger Beaumont.

“They are getting into customers’ accounts through surreptitious means, be it conning or tricking a customer into revealing information or panicking a customer into thinking they need to pay something when in actual fact they don’t.”

According to a survey by financial and policing institutions, New Zealanders lost $198 million to scammers in 2023 but that figure is believed to be wildly conservative.

Part of the reason for that? Many of us are too embarrassed to even report that we’ve been hoodwinked.

Another survey, by the Global Anti-Scam Alliance (GASA) and Netsafe, puts the total figure lost by Kiwis at more than $2 billion.

These two organisations describe scams as “one of the most pressing challenges of our time”.

“Beyond the financial repercussions, scams erode trust, inflict emotional trauma and undermine the very fabric of our digital society,” says GASA managing director Jorij Abraham.

Their survey of 1000 New Zealanders reveals scams are on the rise. “Over half witnessed a rise in scams over the past year, emphasising the growing threat.”

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/AZGU24ZV7ZEFBK5BRHDIZ4LDXM.jpg) Scam Q3

Scam Q3

Abraham says scammers tailor their tactics to the Kiwi digital landscape.

“Platforms like Gmail (43 per cent) and Facebook (37 per cent) are primary hunting grounds. Identity theft emerged as the paramount concern, haunting 20 per cent of our respondents. Tales of online shopping mishaps, unauthorised credit card transactions and counterfeit charity fronts abound.”

Seventeen per cent of the survey’s 1000 respondents had been scammed, losing an average of $3165.

/cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/BBLGTW7EEJFC3CB3ANAJUPJVQE.jpg) Scam Q5

Scam Q5

Abraham said it was “alarming” that scams accounted for 0.5 per cent of New Zealand’s GDP, “highlighting a pressing concern for the nation’s economic health”.

“Recovery tales are few and far between, with a mere 15 per cent managing to reclaim all their lost funds. The emotional toll is evident, with 53 per cent admitting to a significant emotional impact post scam.”

Both Abraham and Beaumont tell of that deep emotional strain.

“Scams are devastating for anybody because they can be anything - from $2 being taken from your bank account to your entire life savings. The impact is significant and awful,” says Beaumont.

A respondent to the GASA survey reported: “The ‘cancer society’ scam was a jarring experience, realising I had been duped by a fake charity.”

Authorities and companies are now acting with more urgency - and much more publicly - to target the scammers.

There’s now no shortage of agencies, banks and other parties investing considerable sums of money to warn the public of the fraudsters’ many methods, and how to avoid being scammed.

MBIE and the Banking Ombudsman launched a social media campaign in November featuring psychologist Nigel Latta.

The Financial Markets Authority launched a similar campaign using Tom Sainsbury.

ASB has launched a new marketing campaign featuring “Ben and Amy”.

And the Banking Association is supporting a new, independent NZ Herald editorial series, which will speak to victims, reveal the lengths the scammers will go to trick consumers and quiz the experts on how they’re trying to fight back. We’re investigating the scope of the issue, speaking to those trying to combat scammers on the frontline, and offering tips and advice on how to avoid being scammed.

MBIE also launched a Fraud Awareness Week in November.

MBIE chairs the interagency fraud working group which also includes Cert NZ, Netsafe, the Serious Fraud Office, the Retirement Commission, the Financial Markets Authority, Internal Affairs, police, the Banking Ombudsman, the telecommunications forum and banking industry representatives.

An MBIE spokesman, Ian Caplin, said in November that scammers targeted everyone across New Zealand. Especially vulnerable were those who had savings and investments, and looking to earn more from their money.

“It’s important to remember real investments don’t just come out of the blue. If it seems too good to be true, then it probably is. If you receive unsolicited investment offers via email or through a ‘cold call’, ignore it.

“It’s illegal to sell financial products through these methods in New Zealand.”

He says if people think they have been scammed, they need to report it to their bank immediately.

“If you don’t understand it, walk away. Before you make any investment, understand how the investment works.”

But as the GASA and Netsafe survey revealed, not many of us are reporting scams to our banks or law enforcement. Their survey revealed “a significant” 59 per cent of victims did not report a scam, “echoing a sentiment of resignation rather than resistance”.

Only 35 per cent of respondents turned to law enforcement or other governmental agencies.

Banks themselves have been under scrutiny and criticism with calls from Consumer and financial experts for better customer protection. The Government has also now stepped in.

One significant move to kneecap fraudsters would be a confirmation of payee system, widely used in the UK.

As NZ Herald technology editor Chris Keall reported in February, it works like this: “If you believe you’re about to make a payment to Jane, but the bank account you are sending money to is registered to Mr A Naughtyman - as Consumer put it - the CoP process will flag the discrepancy before you make the payment”.

The system will also sound an alarm if someone thinks they’re depositing money into a company’s account but is actually owned by an individual.

“It can also raise a yellow flag if a name is a letter out, or an account number a digit wrong, helping to prevent a fat-fingered transfer of funds to the wrong account,” reported Keall.

The Government has now stepped in, with Commerce and Consumer Affairs Minister Andrew Bayly writing to the banks and saying he has given the banking sector until September to update him on a voluntary reimbursement scheme and until the end of the year to introduce the confirmation of payee system.

Pushed by the Herald’s Lane Nichols on whether he would regulate the banks if they failed to act voluntarily, Bayly replied: “We’re certainly asking them to move at pace.”

“We’re making a decision at that point. I’m not going to prejudge that. I hope they do come back with something that gives people confidence.”

His letter warns banks to take “immediate and concerted action”.

“I will be closely monitoring your progress and have asked my officials to keep me updated. I expect you to prioritise this work.”

Consumer boss Jon Duffy has applauded banks for now working on a confirmation-of-payee solution but said it should have happened years ago. “It needs to be done in double-time to make up for years of under-investment.”

Beaumont says there is a lot of work going on “at pace” in this area, and the industry would have an update on the timeframe next month.

Australia was also working hard in this area and was targeting later this year or early 2025 for implementation. New Zealand is on a similar timeline.

“It’s not as simple as flicking a switch and doing that, otherwise we’d have done it by now,” says Beaumont.

“There’s actually a lot of technical and security work that needs to be done to have bank systems talking to each other and exchanging that information, but doing that in a way that we can respect privacy laws and customer confidentiality at the same time.”

People also needed to realise that while it was another weapon in the armoury, it was not a silver bullet.

Beaumont says many banks had stopped sending text messages with web links and “others will follow pretty soon”.

He said this was an “absolute priority”./cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/ZRPYKXGKPJC37ISGLK6LD5Q5FI.jpg) Banking Association chief executive Roger Beaumont. Photo / Getty

Banking Association chief executive Roger Beaumont. Photo / Getty

Beaumont says scams will always be with us. Thieves will always try to break down the virtual walls of your bank account.

He describes it like a game of “whack a mole”.

While banks acknowledge their role to play, he says - and there’s more to be done - they also say it takes a village to raze a fraudster.

They want to see telcos, social media and search engine companies playing their part.

“When you think about how a scam plays out, the money leaving your bank account is the very last step in that process,” says Beaumont.

“It might be a fake ad in social media that makes you click on a link that’s promoting something dubious. It might be a phone call from a scammer that is coming from an illegitimate source.

“It might be a text that you’ve been sent via your telco with an embedded link that is a complete and utter scam.”

He cites examples of search engines that throw up fake bank websites.

“You might go into a search engine to quickly bring up your bank so that you can log in with your details. Now, that might sound a really logical thing to do but what happens is that the scammers might impersonate a bank website.

“So it comes up on your search and it looks entirely like your bank - it looks all familiar, the same logo. You log in your banking details, not realising that you’re logging into a scammer’s account rather than your bank’s account.”

Beaumont says customers should strive to type in their bank’s URL address (eg, asb.co.nz or bnz.co.nz) directly.

“Banks are just at the end of the chain, the last point of contact when the money leaves your account, there’s a whole ecosystem of activity that’s happened to that point of the scammer getting through.”

Beaumont points out that good work is under way with the likes of telcos, who are now preventing international fraudsters from being able to mimic banks’ official phone numbers when they call victims.

“It’s someone sitting in Romania who has created a system where they can mask where they’re calling from and actually create this fake impression that they’re calling from a local number here in New Zealand, which happens to be your bank.”

Telcos and banks have worked together, whereby banks have supplied numbers that could be mimicked from offshore.

“[The telcos] block that number if it is replicated from an overseas-sourced call; it just doesn’t connect.

“Things like that are really good examples of industries working collaboratively to reduce the chances of people being scammed.”

Even the tragic death of politician Efeso Collins was the target of fraudsters after they set up links to fake funeral pages.

It’s a brazen, sickening way to obtain people’s data and other personal details./cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/ITFHWBS4U3TIHB27JCHV3SE4R4.jpg) Fake donation sites were set-up following Efeso Collins' death. Photo / Michael Craig

Fake donation sites were set-up following Efeso Collins' death. Photo / Michael Craig

Keall highlighted the proliferation of fake Facebook pages two weeks ago. He wrote on LinkedIn that many scams and so much fraud would be prevented “if the social media firms would take concrete steps to verify the identity of a person creating a new account”.

Beaumont says scammers are “sophisticated and tricky” and will never disappear.

“There’s always going to be work to be done because, let’s be really clear, there is never going to be a complete end to scams,” says Beaumont. “These are things that are always going to be with us.”

He says banks have to be vigilant - as do customers.

“Everybody has a part to play to be careful and vigilant to reduce the chances of scams occurring.

“Scammers are criminals. They are robbers who are trying to thieve money from people’s accounts and if you put up a barrier, they will try to find a way around that barrier and use all sorts of lies and coercion to try to extract those funds.”

Recent media reports have helped raise awareness of scams and the methods that fraudsters employ.

“I know anecdotally just from family members reading some of that coverage, it’s caused them to say, that could have been me and I need to be more vigilant and more cautious in terms of what I do to avoid being in that same situation.”

Take your Radio, Podcasts and Music with you