SkyCity has struck a deal with the Department of Internal Affairs to resolve court proceedings started in February for non-compliance on anti-money laundering and terrorism financing law breaches.

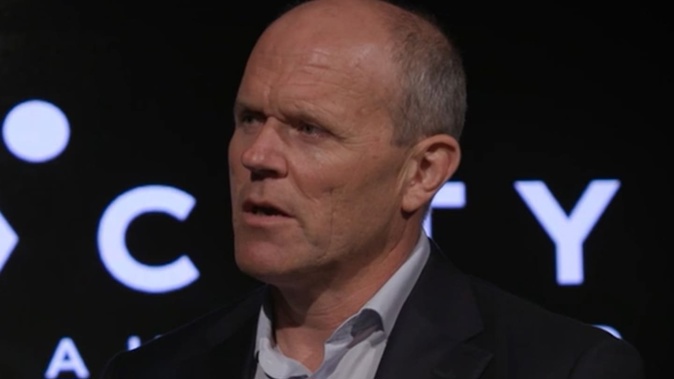

Julian Cook, chairman, today announced the company had admitted it breached its obligations.

“On behalf of the SkyCity board and management team, I accept and apologise for these long-standing failings,” Cook said.

“We have fallen short of the standards we should hold ourselves to, alongside failing to meet the expectations of our regulators, customers, shareholders and the communities we are part of,” he added.

“We are committed to, and have begun, delivering the level of change that is required to meet these expectations.”

Since late 2021, SkyCity has had in place a significant AML/CFT enhancement programme to address compliance systems and correct historical shortcomings,” he said.

Internal Affairs said: “The parties have agreed to jointly submit to the court that a penalty of $4.16m is appropriate in this case, though the final determination is for the court.”

SkyCity had admitted to all five causes of action in Internal Affair’s statement of claim and agreed to pay a penalty for the breaches.

The parties will now recommend to the High Court that proceedings move to a penalty hearing, where a penalty amount will be determined.

Between September 2022 and December 2023, Internal Affairs conducted a review of SkyCity’s AML/CFT compliance, which found it breached the law.

The breached obligations related to its AML/CFT risk assessment, establishing, implementing and maintaining an AML/CFT compliance programme, monitoring of accounts and transactions, conducting compliant enhanced customer due diligence, and terminating existing business relationships when required.

These failures spanned between February 2018 and March 2023.

There was no evidence to suggest that SkyCity was directly involved in money laundering or the financing of terrorism, Internal Affairs said.

Players in action at SkyCity. Photo / Peter Meecham

Mike Stone, Internal Affair’s director of the AML/CFT group, said today: “This agreement is an impactful outcome. We have achieved our desired result without the extended duration and cost of court proceedings.

Stone added: “While we consider these regulatory breaches to be serious, we are pleased that SkyCity was able to admit to the breaches and acknowledged responsibility for what were significant failings.

“It is encouraging to see the work SkyCity has already done to lift its performance in this area and its public commitment to continue to improve. We will be working closely with SkyCity in the future in relation to its ongoing compliance obligations,” Stone said.

Cook said that since late 2021, SkyCity had a significant AML/CFT enhancement programme in place. Changes had included:

-Completing a refresh of the board;

-Recruitment of directors with specialist risk expertise;

-Creation of a dedicated board risk and compliance committee to oversee AML/CFT, host responsibility, risk and other compliance obligations;

-Increased internal audit capabilities and enhanced external audit scrutiny with oversight by the audit committee and the risk and compliance committee;

-Appointment of a group chief risk officer;

-Significant enhancement and investment in internal AML/CFT resourcing and capability, processes and systems, including development of enhanced transactional monitoring capabilities;

-Applying higher standards of due diligence on customers as appropriate, lowering cash thresholds before enhanced customer due diligence is required, and ceasing to deal with junket operators;

-Continuing to increase capacity in financial crime, risk and compliance and host responsibility teams, with approximately 100 employees as at 1H24;

-Reducing risk and complexity in the business by changing policies in line with a lower risk tolerance, limiting ways in which customers can transact;

-Committing to implement mandatory carded play across New Zealand properties by mid-2025.

Anne Gibson has been the Herald’s property editor for 24 years, has won many awards, written books and covered property extensively here and overseas.

Take your Radio, Podcasts and Music with you