Kiwi Property Group, with $3.6 billion of real estate, has released the first image of how Ikea's inaugural New Zealand store will look at its Sylvia Park centre, Mt Wellington.

Kiwi has also announced it pushed up bottom-line profit 14 per cent partly because of big property revenue rises from an expanded Auckland shopping centre and revaluation boosts.

One of the largest listed landlords, it has reported a strong performance, announcing it has pushed up last year's $196.5 million net profit after tax to $224.3m for the March 31 years.

Its big real estate portfolio rose in value $99.8m last year but $120.5m this year.

Property revenue rose from $232.5m to $245.1m and the company said that was assisted by the Sylvia Park level 1 expansion, adding an extra floor on to its Mt Wellington mall which is New Zealand's largest shopping centre by car parks and floor area.

Pre-tax profit rose strongly from $222.4m to $260.7m.

The company also cited its deal with Ikea which plans to open beside Sylvia Park on land the Swedish business is buying.

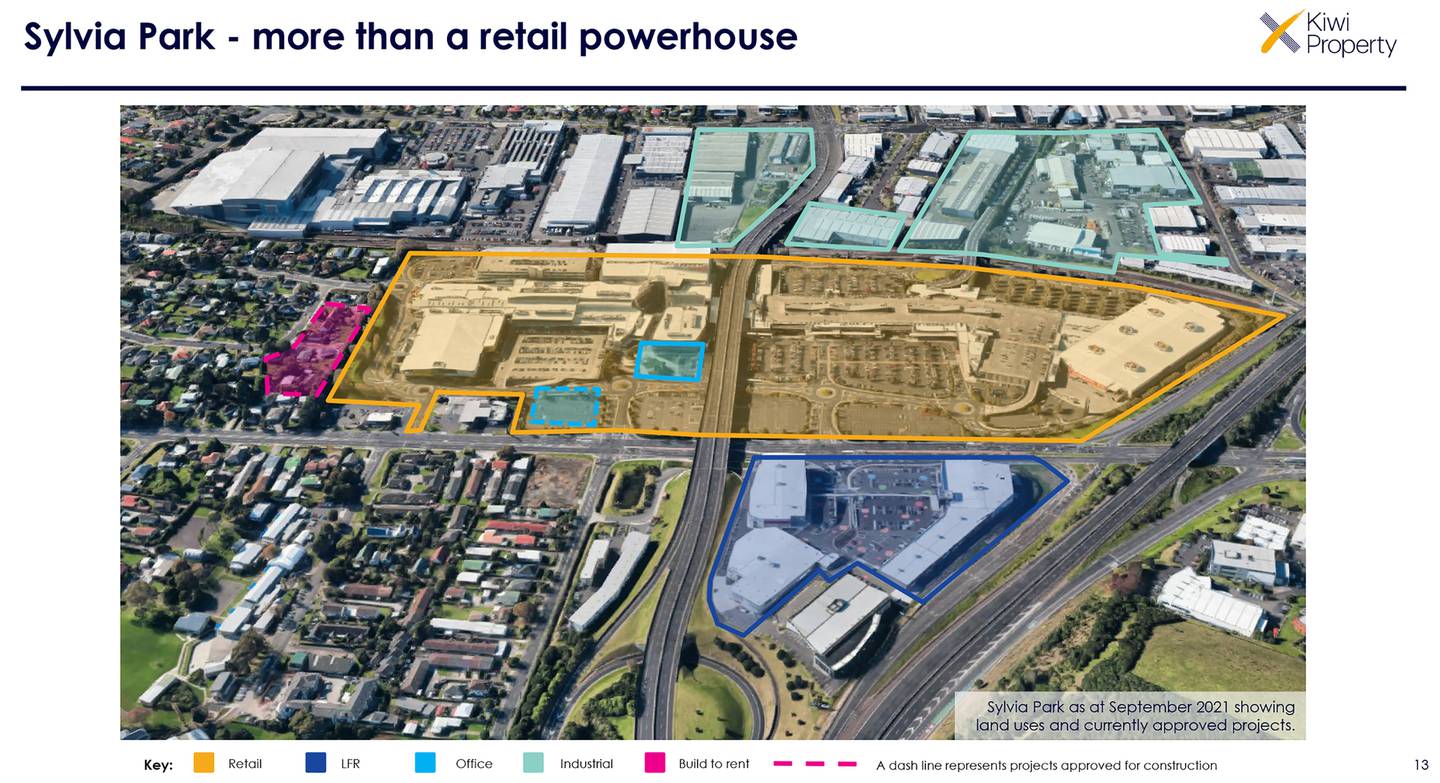

Kiwi said it had struck the deal with the European giant to sell it 3.2ha of land on Te Ahoterangi Rise, east of the existing Sylvia Park shopping centre.

Ikea's site is directly opposite the back of Farmers, beside The Warehouse, but on the other side of the train tracks from the existing Sylvia Park centre.

A new image in the investor presentation showed a huge blue store on the Mt Wellington site, with a car park and landscaping out the front. The Ikea sale was listed under "intensifying mixed-use assets: transforming Sylvia Park".

There, Kiwi was referring to changing uses at the centre with new offices as well as hundreds of apartments in what is now flat asphalted car parking areas around the perimeter of the mall.

Kiwi's big Sylvia Park plans, with State Highway 1 to the right. Photo / supplied

The intention is to build on that flat land, creating long-term assets which earn constant income streams, moving those car parks into existing new buildings when they rise.

Kiwi indicated it was looking forward to Ikea's arrival.

"The agreement marks an important step towards Kiwi Property's aim of welcoming Ikea to the precinct," it said in today's presentations.

Kiwi also intends to develop a complementary 6430sq m lifestyle retail centre, directly adjacent to the land conditionally sold to the iconic retailer.

Ikea will partly front the newly created Te Ahoterangi Rise, which will run from Carbine Rd into the entry to Ikea's car park.

Precisely when construction of the new Ikea will begin and when it will open is as yet unknown.

Kiwi said it had continued in the latest year to build strategic momentum in the year, it said, due to improved trading conditions underpinning a 3.5 per cent or $120.5m gain in the fair value of its portfolio, independently valued at $3.6b.

Office asset valuations rose 3.8 per cent and valuations on mixed-use properties were up 2.3 per cent. Net tangible assets per share rose 9cps to $1.45.

Net rental income up 7.8 per cent to $187.1m was bolstered by a full period of trading at Sylvia Park's successful level one expansion, it said.

Kiwi's Sylvia Park shopping centre, where Ikea plans to open. Photo / supplied

Tenants are doing well too: total sales at Kiwi malls and large format retail centres rose 6.7 per cent in the latest year.

Sylvia Park was "the standout performer" and Ikea has announced it will open its first store there.

Construction of Kiwi's first residential development via build to rent at Sylvia Park began in November. That is a $221m 295-unit scheme and a second scheme like that is planned at Kiwi's LynnMall.

Development of a second office building has also started at 3 Te Kehu Way, Sylvia Park. That $63 million project is to feature flexible co-working facilities and also cater to the specialist requirements of medical practitioners. So far, 30 per cent of the new offices are pre-leased.

Kiwi also got its private plan change approved for its 53ha Drury site which is to become a new town centre where around 60,000 people will live in the next 25 years.

Clive Mackenzie, Kiwi Property's chief executive. Photo / supplied

The company has also won consent for a 25-storey LynnMall mixed-use tower which it said is set to accelerate the centre's evolution into a different sort of community. Ground floor retail, three office levels and 245 build to rent apartments are planned there.

Construction will begin in line with funding and approval, Kiwi said today.

Clive Mackenzie, chief executive, said: "Kiwi Property's current pipeline of development opportunities is one of the most exciting in the company's history. Thanks to our extensive landholdings, we have the flexibility to proceed with new projects at our own pace. This is particularly important in the current market and enables us to undertake development activity when input costs and market conditions are supportive."

Kiwi is one of the largest listed property companies on the NZX and is a member of the S&P/NZX 20 Index.

It was formed around 25 years ago and mixed-use, retail and office buildings.

S&P Global Ratings has a BBB or stable rating on the company. Kiwi says it is the highest-rated New Zealand company within the carbon disclosure project.

Shareholders will get a final cash dividend of 2.85cps for the six months to March 31, up from the 2.75 cps interim dividend.

Payment will be made on June 22.

The total cash dividend for the year is 5.60cps, up 8.7 per cent on the 5.15cps paid in the previous year. The company is targeting a FY23 cash dividend of no less than 5.70cps

Shares were on Friday trading at $1.01, down 15 per cent annually. It has a market capitalisation of $1.5b.

- by Anne Gibson, NZ Herald

Take your Radio, Podcasts and Music with you