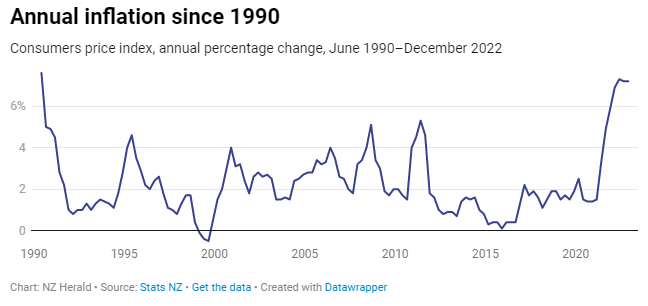

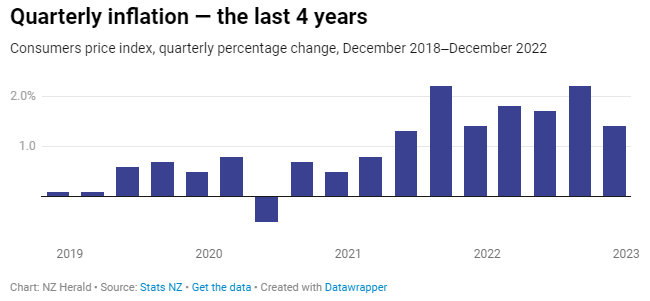

The consumers price index increased 7.2 per cent in the 12 months to December 2022, Stats NZ said today.

It follows months of high inflation where prices frequently rose faster than at any time since the early 1990s.

The 7.2 per cent increase follows another 7.2 per cent annual increase in the September 2022 quarter, and a 7.3 per cent increase in the June 2022 quarter.

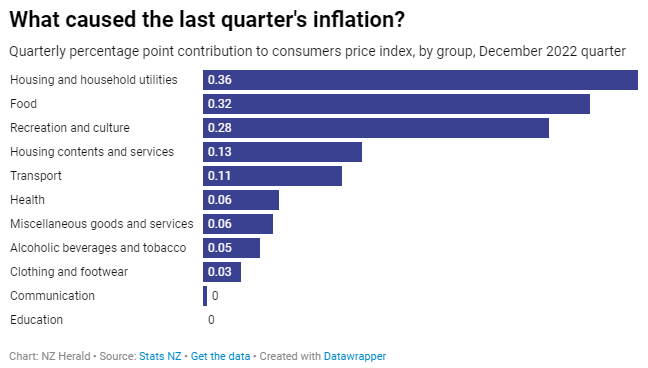

Housing and household utilities were the biggest contributors to the December 2022 annual inflation rate.

That was due to rising prices for both constructing and renting housing.

“Higher prices for ready-to-eat food, vegetables, and meat and poultry drove the overall increase in food prices,” Stats NZ said.

Transport was the next largest contributor, driven by rising prices for both international and domestic air fares.

The New Zealand dollar briefly rallied by about a quarter of a US cent on the back of the news.

In the minutes following the 10.45 am release, the Kiwi shot up to US65.23 cents from US65.0 cents. The currency later settled back to US65.08c. Wholesale interest rates were little changed.

- ASB: No guarantee that inflation is going down

- ANZ Economists predict inflation to be 7.2 percent once more

BNZ economist Doug Steel said there was some volatility in the foreign exchange market immediately after the release, but the outcome was largely in line with expectations.

Pundits had predicted inflation would be below the 7.5 per cent reading the Reserve Bank forecast in November.

But they weren’t all convinced that would be enough to persuade the central bank to ease aggressive official cash rate (OCR) hikes.

The data release also coincides with today’s swearing-in of Chris Hipkins as the new Prime Minister.

Hipkins has said tackling inflation and rampant cost of living increases will be among his top priorities.

At the weekend, Hipkins said his Government would focus on the immediate “bread and butter issues” affecting people.

“You shouldn’t have to be on a six-figure salary to buy a new house,” Hipkins said.

But with a range of domestic and global factors influencing inflation, the new PM may face a big challenge.

Just last week, Stats NZ revealed food prices jumped 1.1 per cent in December and were 11.3 per cent higher than a year earlier.

That was the biggest annual food price increase in 32 years, as fruit and vegetable prices increased 23 per cent year-on-year.

CPI inflation for the year to September was 7.2 per cent - well above expectations of about 6.5 per cent.

Domestic (non-tradable) inflation rose in the September quarter from 6.3 per cent to 6.6 per cent.

Take your Radio, Podcasts and Music with you