Revenue and bottom-line profit from New Zealand’s biggest listed construction company dropped in the face of the housing downturn and writedowns on its NZ International Convention Centre job in Auckland.

Fletcher Building chief executive Ross Taylor reported the result for the year to June 30.

Revenue fell slightly but the big change was the cost of significant items, up 457 per cent, resulting in net profit after tax falling 45 per cent from $432m to just $235m.

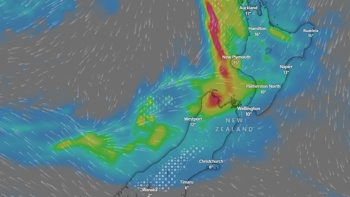

Taylor cited the softer residential markets here and in Australia, and the major weather events in the second half.

“Net profit after tax was $235m, impacted by significant items charges of $301 million. The significant items related mainly to additional provisions of $255 million on the New Zealand International Convention Centre and Hobson Street Hotel (NZICC) project,” Taylor said.

Cash flows from operating activities were $388m, down on $592m last year.

Adjusting for tax, funding costs and lease principal repayments, Fletcher Building businesses generated trading cash flows of $475 million compared to $462m in FY22.

The company said its balance sheet was strong with $1.4 billion liquidity.

The board has approved a fully imputed and unfranked final dividend for the year of 16cps to be paid on October 5.

Combined with the 18cps interim dividend, this brings the total dividend to 34cps for the year.

“Looking forward to FY24, we expect some further tightening in our overall volumes and so our focus remains on strong customer performance, cost control and pricing disciplines across our businesses. We have shown we are well equipped to continue performing solidly through the cycle,” Taylor said.

Repairs are still under way to the NZICC, nearly four years after the massive 2019 fire. Photo / Supplied

“We also continue to look beyond the cycle and are now well into our $800m growth investment programme for the period FY23-FY26. Identified opportunities have been assessed against robust criteria including exceeding our ROFE [return on funds employed] target rates of 15 per cent.

“These include the Laminex Taupō wood panels plant, Comfortech insulation, a new frame and truss plant and the acquisitions of Tumu and Waipapa Timber. These will progressively mature over the coming couple of years and by FY27 we would expect to see a full run-rate ebit uplift of approximately $120m to our underlying earnings base,” Taylor said.

The $400m Winstone Wallboards’ plasterboard manufacturing and distribution plant in Tauranga has now started production and will be fully operational by the end of October.

The new plant’s technology delivered more production capacity allowing for product innovation and future growth.

“Reflecting on all we’ve accomplished over the past year, I’m pleased with the way our people have continued to show their resilience, innovative spirit and commitment to supporting our customers and each other. I also wish to acknowledge and thank our shareholders, customers and suppliers for their continued support,” Taylor said.

The company employs more than 14,500 people in New Zealand, Australia and the South Pacific. It operates in the manufacturing, distribution and retail, home building and major construction and infrastructure projects sector.

Analysts forecast it to report earnings before interest and taxes or ebit of about $800m for the year, up from $756m in the prior year. That excludes an extra $105m provisioning it made last week for losses on SkyCity Entertainment Group’s New Zealand International Convention Centre and neighbouring Horizon Hotel.

But Fletcher said it would continue to try to recover that under its third-party liability insurance.

A week out from reporting the result today, Fletcher reiterated ebitda guidance before one-off costs.

The 2019 fire at the NZ International Convention Centre construction site. Photo / Dean Purcell

Last Wednesday, Jarden analysts Grant Swanepoel and Luan Nguyen released a Fletcher analysis ahead of today’s result, headlined Auckland showing signs of having bottomed.

Auckland real prices are now below the level they were at at the start of the recent bull run, they noted.

“Auckland prices are starting to show signs of some support coming in while ex-Auckland continues to decline,” they wrote. Auckland prices are up 18 per cent on June 2019. But in real terms, prices in that city are now down 1 per cent on June 2019.

NZ house prices are still up 30 per cent on June 2019, the start of the last rally, they noted, although when inflation is taken into account, they are up in real terms by only 6 per cent, the Jarden analysts said.

“At its recent investor day, Fletcher indicated that FY23 overall volumes were 5 to 7 per cent below the peak in 2H22 volumes and that the company expected a further 8 per cent market volume decline in FY24 versus FY23, with softer residential offsetting ongoing solid commercial/infrastructure,” Swanepoel and Nguyen wrote.

“This implies that Fletcher expects housing activity to be down circa 10-15 per cent off FY23 and circa 20-25 per cent off peak FY2H22. Our analysis concurs with this view. In contrast, Golden Bay Cement has indicated that there has been little slowdown in its concrete volumes,” they noted.

They expect the year to June 30, 2024, to be softer than previously indicated and lowered their Ebit estimate modestly from $686m to $683m. The expected economic slowdown, which started in the 2023 year’s second half, would affect that result, they forecast.

Jarden forecasted adjusted net profit after tax of $339m for the June 2023, year, down on 2022′s $486m. Jarden forecast that to rise to $345.8m in the 2024 year and $382.5m by 2025.

Revenue of $849m in 2022 was forecast to come in at $861m this year, falling to $850m next year but rising to $890m by 2025.

Fletcher, with a $4.3b market capitalisation, has been trading on the NZX around $5.52, only down 2 per cent annually.

Anne Gibson has been the Herald’s property editor for 23 years, has won many awards, written books and covered property extensively here and overseas.

Take your Radio, Podcasts and Music with you