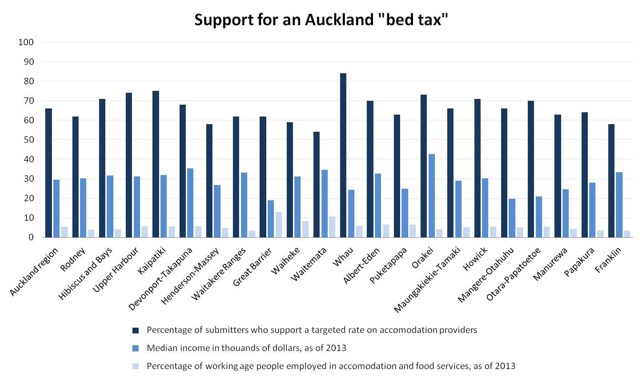

The idea of an Auckland "bed tax" is extremely popular in wealthy suburbs and far less popular in parts of the city that depend on hospitality jobs.

Councillors will vote today on Auckland Council's annual budget, which includes a 2.5 percent rates rise and a targeted levy on accommodation providers.

Auckland mayor Phil Goff has proposed the levy to maintain spending on tourism and events, while avoiding major increases to general rates.

Sixty-six percent of people who made submissions on the Auckland Council budget said they would rather raise the money through a targeted rate than through general rates.

The idea was most popular in the Whau local board area covering New Lynn and Kelston, where 84 percent supported it and almost no one opposed it.

It was also supported by more than 70 percent of submitters in Orakei, and in North Shore local board areas like Kaipatiki, Upper Harbour and Hibiscus and Bays.

Those four areas have relatively small hospitality sectors, with less than 6 percent of people working in accommodation and food services.

Opinion was more divided in the central Waitemata local board area, where only 54 percent of people prefer a targeted rate, over potentially higher general rates.

The area has the highest concentration of hotels and hospitality workers of any mainland area -- 10.65 percent of people work in the sector.

On Great Barrier Island, 12.9 percent of people work in the sector, and only 62 percent of people supported the levy.

In the Waiheke local board area, 8.22 percent of people work in the sector, and only 59 percent of people wanted a levy, despite growing anxiety about visitor numbers.

One submitter said the levy would penalise accommodation providers. Another said it would be particularly harsh on Waiheke businesses, and would punish other Aucklanders who stay there.

Waiheke Islanders have instead called for altering the wharf tax system, introducing an entry tax, and actually doing away with tourism promotion of the island.

One submitter said “Waiheke is marketed as a jewel in Auckland's crown but its success is causing problems with pollution of our beaches and fisheries”.

Auckland mayor Phil Goff said he's asking his councillors to back the idea.

He believes it is fairer than the current funding system and the public submissions show it has strong public support.

"I really do hope they listen to their constituents who are saying, yes, bring in this targeted rate on accommodation.

"I'm hoping it will go through, because the industry that benefits from the spending by ratepayers ought to be contributing towards the cost of that spending.

Tourism Industry Aotearoa chief Chris Roberts said the so-called "bed tax" is actually an extra rate for certain property owners.

He said they have received legal advice, suggesting it would be illegal for them to pass on the costs as a direct surcharge.

"Some very detailed well-founded submissions were made by the accommodation sector, and ratepayers were basically misled from the beginning.

"They were told this was a bed tax that would be paid by the visitors, when it's simply not a bed tax."

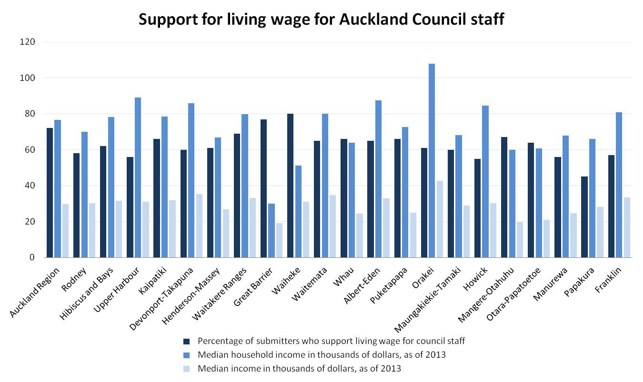

Support for living wage

The proposed budget includes a living wage for Auckland Council staff.

Support for the living wage is often higher in areas with lower median incomes.

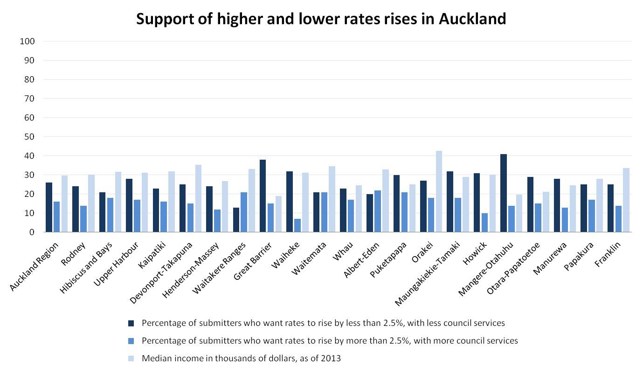

Support for higher or lower rates

The proposed budget includes an average rates rise of 2.5 percent.

In the local-income Mangere-Otahuhu area, 41 percent of people wanted a lower rates increase and only 14 percent wanted a higher rates increase.

In the wealthier Albert-Eden area, 22 percent of people wanted a higher rates increase and only 20 percent wanted a lower increase.

Take your Radio, Podcasts and Music with you