Workers are the winners in the Government's election year Budget which delivers more cash in the hand to almost everyone - including $2 billion worth of tax cuts and boosts to Working for Families.

The centrepiece of the Budget was the Family Incomes Package' which included a mix of tax cuts, and increases for many on Working for Families and the Accommodation Supplement - a package which will cost $6.5 billion over the next four years.

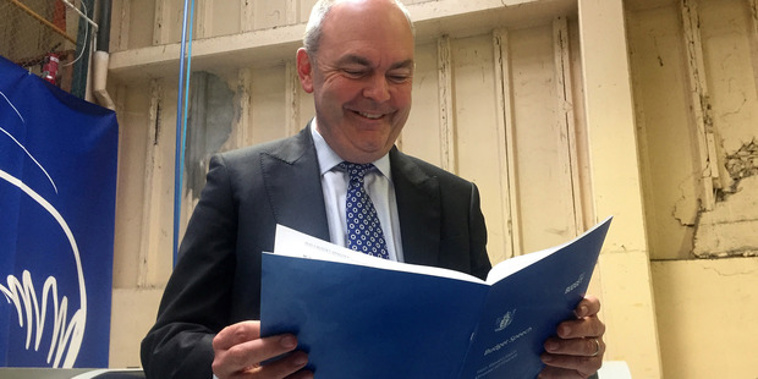

Finance Minister Steven Joyce said it was expected to benefit about 1.3 million families by an average of $26 a week as well as 750,000 superannuants and 41,000 students.

BUDGET 2017: Ten things you need to know

BUDGET 2017: $100m to free up Auckland land for housing

BUDGET 2017: Mental health, disability support get boost

BUDGET 2017: Govt commits $4b to new rail, schools, hospitals, prisons

BUDGET 2017: Defence Force gets $1 billion for new ship, technology

BUDGET 2017: Govt starts paying for Auckland's rail link

BUDGET 2017: School funding freeze 'over'

BUDGET 2017: Millions to be spent to try to cut burglary and youth offending

BUDGET 2017: Insurance premiums to rise by $69 for homeowners

It includes a tax cut of about $11 a week for workers on more than $22,000 and $20 for those on more than $52,000 a year. Those on more than $127,000 will get about $35 a week.

That was from moving up the bottom two tax rate thresholds - the lowest threshold will lift from $14,000 to $22,000 and the second from $48,000 to $52,000.

The tax changes will apply from April next year and leave an estimated $2 billion a year in workers' pockets once in place.

Joyce also signalled further tax cuts ahead, saying the Government would continue to adjust taxes where it had the money to do so.

The biggest boost was for beneficiaries and those on low incomes who get the Families Tax Credit under Working for Families and the Accommodation Supplement - some of whom will get more than $145 a week more.

Working for Families family tax credits will rise by $9.25 a week for a first child under 16, and between $17.75 and $26.81 for other children - expected to cost about $318 million a year from 2019. It means families get the same rate for younger children as for those aged 16-18.

The Budget also delivers an average boost of $35 a week for 136,000 households getting the Accommodation Supplement.

Some will get up to $145 more because areas such as west and south Auckland and Christchurch have been moved into categories which get higher payments because of high rents.

Some families on middle incomes will get less - or no longer be eligible for Working for Families payments - because the Government has dropped the income threshold at which the credits start to abate from $36,350 to $35,000 - and increased the rate at which the entitlements abate from 22.5 cents in the dollar to 25 cents in the dollar.

The Government had initially intended to phase those changes in over time until 2025 to give families time to adjust.

Joyce said the tax changes would more than offset the abatement changes in most cases. Those most affected would be those on higher incomes who only had 16-18 year old children.

The Government has also scrapped the $10 a week Independent Earner Tax Credit for about 500,000 people without children, saying only one third of those eligible claimed it and the tax cuts would provide the equivalent amount.

The income tax threshold changes were to reflect the increase in the average wage to $58,900 over the last seven year.

"The Families Income Package is carefully designed to especially assist low and middle income earners with young families and higher housing costs," Joyce said.

Super-annuitant couples will get an extra $13 a week because super is pegged to after-tax wages and students on the accommodation benefit will get up to $20 a week more.

However, critics are likely to be unimpressed.

Labour has claimed the Working for Families payments were due to increase anyway - they are indexed to increase every time the CPI increases by five per cent and the last adjustment was in 2007. Since then the CPI has increased by 5.5 per cent.

The decision to bring forward changes to abatement rates and thresholds will mean many will also miss out.

The Accommodation Supplement was also overdue for an increase - it has not been adjusted since 2007 when it was set to reflect rents at the end of 2005.

Other significant Budget reveals include $450 million for the first tranche of Government funding for Auckland's City Rail Link and over $1 billion more for prisons over four years.

There is also a $450 million package for KiwiRail.

WHAT PEOPLE GET IN TAX CUTS, WFF CHANGES AND ACCOMMODATION

How will it affect you? Visit Working For Families to see

• A single parent earning $33,000 with a 14-year-old in Waitakere: $11 tax cut, $9 Working for Families and up to $110 more in Accommodation Supplement.

• Single parent earning $55,000 with two children under 12 in Auckland Central: $39 a week and up to $80 Accommodation Supplement.

• Single person earning $130,000 a year: $34.65 a week tax cuts.

• Couple, both on average wage: $41 tax a week between them

• A couple with no children who earn $55,000 and $33,000 - $31 in tax but lose $10 Independent Tax Credit - total $21 more.

• Christchurch couple with two children on one income of $55,000: $20 in tax cuts and $21 more in Working for Families, up to $100 more Accommodation Supplement.

Take your Radio, Podcasts and Music with you